However, traditional methods often require large capital investments, deep market knowledge and hands-on management making real estate a high-yield investment option. Nevertheless, the introduction of crowdfunding in real estate has made it possible for investors to invest in property with little or no hassle and small amounts of money. In this guide you will learn the basics real estate crowdfunding its advantages and how to start.

Also read – Master Passive Income: A Complete Guide to Blogging Success

What Is Real Estate Crowdfunding?

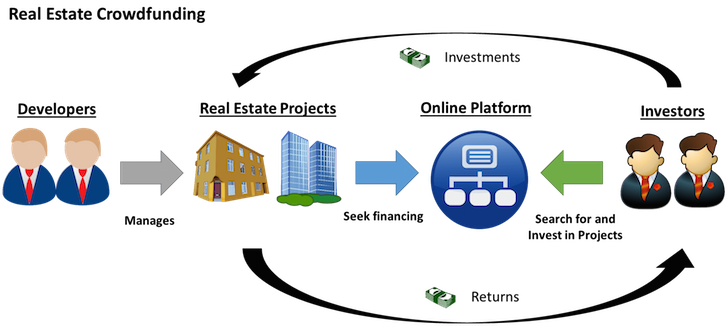

Real estate crowdfunding is a technique that involves pooling funds from multiple investors to raise capital for property development. Instead of buying whole properties, individuals can invest in real estate through this business model. Here, they acquire stakes in specified housing projects or portfolios managed by established developers or qualified property specialists.

Types of Real Estate Crowdfunding

- Equity Crowdfunding: In return for purchasing shares in a property/project, investors receive some proportion of rental income or profit when the property is sold. Nonetheless, this type of investing can yield higher returns at the same time it bears more risks.

- Debt Crowdfunding: Investors who lend money to developers get fixed interest rates as compensation. Normally considered less hazardous than equity-based crowd-funding, but gives lower returns most times.

- Hybrid Crowdfunding: Some platforms offer combined equity and debt crowdfunding in their quest to diversify investor portfolios and optimize risk/return trade-offs.

How Real Estate Crowdfunding Works

- Step 1: Platform Selection: Investors select a crowdfunding platform that matches their investment goals and appetite for risk.

- Step 2: Project Selection: Investors can look at offerings such as residential, commercial or industrial properties among other real estate projects.

- Step 3: Investment: Subsequently, they give capital to the project often starting from an initial investment requirement.

- Step 4: Management: The platform running the crowdfunding campaign or an external manager is responsible for everything from property management to sale of the asset.

- Step 5: Returns: Crowdfunding participants usually receive dividends paid out regularly on either a monthly or quarterly basis depending on whether it was done as debt or equity financing (Liu and Zhang 2016).

Benefits of Real Estate Crowdfunding

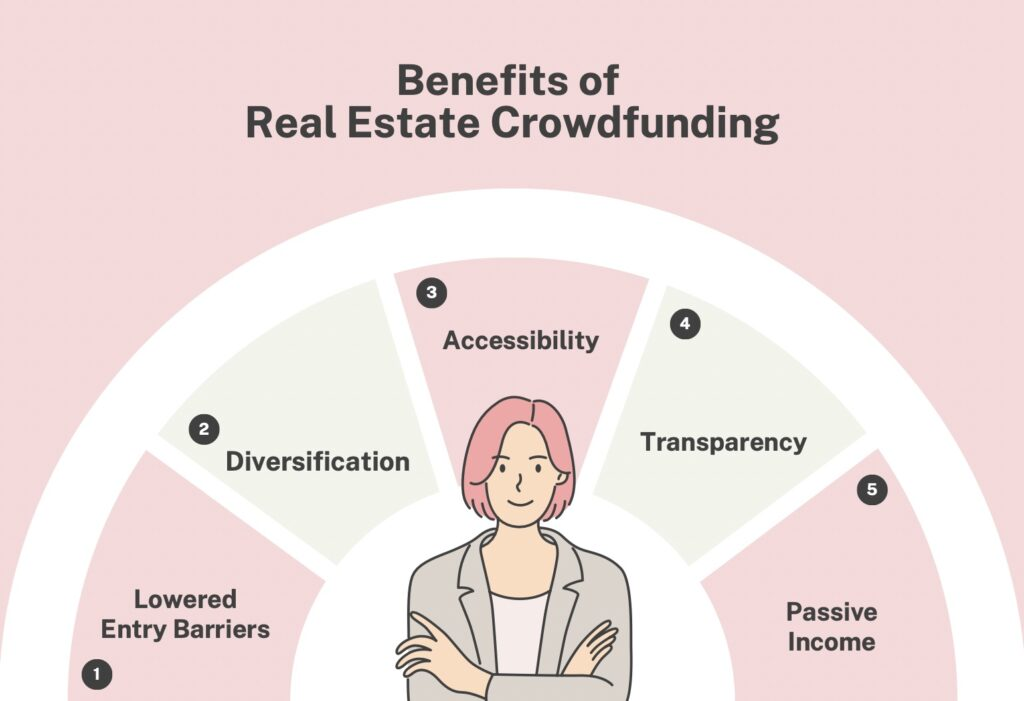

Real estate crowdfunding has many advantages over traditional ways of investing in property which therefore makes it attractive for a wide range of investors, including individuals who do not possess significant financial resources.

1. Accessibility

The ability to access these investments is one of the most significant benefits of real estate crowdfunding. Traditional real estate investments often require significant capital and industry expertise. Crowdfunding platforms lower the barriers to entry, allowing individuals to invest in real estate with smaller amounts of money and without needing deep market knowledge.

2. Diversification

Crowdfunding allows investors to diversify their real estate portfolios by spreading their capital across multiple projects and property types. This diversification helps mitigate risk by not relying on a single investment for returns.

3. Passive Income

For those looking for a hands-off investment, real estate crowdfunding provides an opportunity to earn passive income. Once an investment is made, the crowdfunding platform or a property manager takes care of the day-to-day operations, including tenant management, maintenance, and rent collection.

4. Potential for High Returns

While real estate crowdfunding involves risk, it also offers the potential for significant returns, particularly in equity crowdfunding, where investors can benefit from property appreciation and rental income.

5. Transparency

Most real estate crowdfunding platforms provide detailed information about each project, including financial projections, property details, and risk assessments. This transparency allows investors to make informed decisions and understand where their money is going.

Risks of Real Estate Crowdfunding

However, it is important to note that with crowd-funding properties, there are still risks that need to be taken note of. Knowing these risks will help you in making the right decisions and optimizing the management of your investments.

1. Market Risk

Real estate is subject to fluctuations, and any downfall in the market can adversely affect one’s investments. All factors including economic conditions, interest rates as well as local real estate environments influence the success of a particular real estate project.

2. Liquidity Risk

In most cases, real estate crowdfunding investment entails subscription for shares in a company which is project based. Here contracts lock in the investors for a while which makes it hard to dispose of one’s share or cash out until the project is complete. This illiquidity shall be viewed negatively in terms of access to those funds by the investors as they could want to avail to such funds within a short timeframe.

3. Platform Risk

In most cases, how your investment performs or rather the returns are largely dictated by the crowdfunding site one decides to use. Incase, the site has liquidity problems or it closes down, your investments are at great risk. It is important to look for some history regarding the platform’s past performance as well as legal compliance before making an investment.

4. Project Risk

Apart from appreciating in value and stability, all forms of investment including real estate have risks which are given the general perception of volatility. Such other risks associated with real estate even crowd funded properties include time overruns, budget estimations as well as management risks. When and if such failures occur, then the returns from the project will also be reduced and it will be onlypartial returns that will be issued to you or full loss of all you invested.

5. Regulatory Risk

Real estate crowdfunding is an activity governed by laws that could vary in time. Some of the rules that come into effect may have a negative effect on the ability to make a return on investment or even to be legal – the ability to offer a certain opportunity. These laws vary from country to country, and it is prudent to be well-versed with the legal framework, and use sites that adhere to the legal framework.

How to Get Started with Real Estate Crowdfunding

Since you’ve grasped everything there is to crowdfunding in real estate, here’s a roadmap for everyone interested in this.

1. Define Your Investment Goals

One thing that has to be taken into consideration before entering real estate crowdfunding is an investment plan. Self-reflect on the following aspects:

- How much can you afford to lose?

- What amount of money can you put in?

- Should you want your capital to appreciate over time or look to generate profits quickly?

- What is the duration you are willing to spend watching the investments?

Being specific in what you want will enable you to narrow down the options of platforms and projects that will eventually meet your expectations on the funds.

2. Research Crowdfunding Platforms

As much as getting affordable properties is great, it is equally wise to select a suitable crowdfunding platform for your success in real estate investment. Below are some of the things that you should assess when reviewing the platforms:

- Track Record: Search for platforms with a good history of investors and successful projects who are happy at the end of the investment period.

- Fees: Get to know about the fees involved with the platforms including; managerial fee, transaction fee, fee for performance status, etc.

- Transparency: Check that the platform has comprehensive information regarding scope of the project which includes financial returns, associated risk and target return.

- Customer Support: Examine the strength of the support offered to clients and the resources at the disposal of investors.

3. Start with a Small Investment

For investors looking to try real estate crowdfunding for the first time, it would be prudent to begin with a small amount of money. This is because it enables you to orient yourself to the routine, appreciate how returns are made, and ascertain the effectiveness of the platform without having to risk too much till you gain confidence.

4. Diversify Your Portfolio

Moreover, diversification is essential when it comes to the risk aspect in real estate crowdfunding. Instead of investing one hundred percent of your capital in a single opportunity, disperse your investment in several projects, geographies, and crowdfunding structures including equity, debt, or a combination of them. Through it, you will be able to level out the risk and lower the adverse effects of any individual investment that does not perform well.

5. Monitor Your Investments

Even though your involvement as an investor in a real estate crowdfunding campaign is mostly limited, constant vigilance on the investments you make is essential. Be on the lookout for any project developments, reports on performance, and market conditions that may be unfavorable to the realization of your investments. There are usually dashboards on many crowdfunding platforms which will enable ease in observing the status of your investments as well as the amount earned. In addition, it is also helpful to constantly supervise your investments since this can enable you to invest dividends to enhance the yield or change the investment strategy in accordance to the prevailing environment.

6. Reinvest Your Earnings

If returns from your investment are being earned by you, think about reinvesting those returns in other investments. Reinvesting your earnings pays off in regard to time as it enables you to grow your returns and enhance your wealth creation endeavors. This kind of approach not only enhances your chances of making more money, but also allow accelerated growth of your earnings by earning money on the previously earned money.

Conclusion

The rise of real estate crowdfunding gave birth to a whole new concept of real estate investing, which is now open for more people, and allows investors to get into profitable real estate deals without high capital and resource requirements. Though there are risks to be dealt with, the rewards are such that it is worth adding to the holdings with the view of enhancing wealth within a given period of time.

You can make passive income from real estate crowdfunding by employing the techniques explained in this guide that includes setting objectives, selecting the right platforms, beginning with small amounts, spreading your risks, watching your funds, and taking back any profits. You can now enjoy the beauty of real estates without putting yourself at risk as you make rational choices as per your financial capacity.

FAQs

Q: How much money do I need to start investing in real estate crowdfunding?

A: The amount needed to get started generally differs from platform to platform, but quite a few undertake the practice of allowing the customers to start from $500 to a maximum of $1,000.

Q: Is real estate crowdfunding safe?

A: Just like all other types of investments, real estates in crowdfunding come with their own share of risks. It is good to research, select reputable companies and spread your investments as a way to lower the risks.

Q: How are returns distributed in real estate crowdfunding?

A: The returns are usually received in three months or less according to the advancement of the project and nature of investment made whether equity or debt.

Q: Can I sell my shares in a crowdfunding project before it’s completed?

A: Real estate crowdfunding funds usually have limited liquidity and as such majority of the investors would not have the opportunity to sell back their equity or cash out before the end of the completion of the project. There are secondary markets available on a few platforms as a feature to sell your shares but this is not always the most dependable solution.

Q: Do I need to be an accredited investor to participate in real estate crowdfunding?

A: There are platforms that only accept accredited investors while there are those that allow non-accredited investors to apply. You have to look at the eligibility requirements of the platform you want to invest in.