When it comes to running your finances as a couple, it’s bedding rock for their bond. It’s a known fact that money is often identified as one of the most stress-causing and conflict-related things in relationships. However, by having the right approach to budgeting, couples can work together through their financial journey so that both partners are on the same page with respect to goals and financial decisions. In this all-inclusive guide, we are going to take a look at some of the best practices of budgeting as a couple giving you tips you need to expert advice in ensuring you manage your finances effectively.

Also read – The 50/30/20 Rule: Simplify Your Budgeting Process

Why Budgeting as a Couple is Essential

However, there is more than splitting bills and expenses when budgeting as a couple; rather, it involves sharing a common financial vision and working collectively towards its achievement. The following are key reasons why couples need to have budgets:

- Promotes Transparency: Budgeting promotes open communication about earnings, outlays and economic objectives eradicating such possibilities like misunderstanding or financial surprises.

- Strengthens the Relationship: On top of that, working together on matters concerning finance will make you stronger as one family unit strengthening trust and cooperation among yourselves.

- Achieves Financial Goals Faster: An intelligently made budget can help achieve shared economic objectives such as buying a house; starting up your own family or planning your retirement.

- Reduces Financial Stress: A lucid budget gives you a feeling of control over your money, which in turn helps to reduce stress and anxiety about money.

Step 1: Start with an Open Conversation

For couples, the bedrock of successful financial management is effective communication. It is very important to discuss your financial situation, goals and expectations before delving into the numbers.

Discuss Your Financial Background

It is important to understand each other’s financial background. For instance, talk about your earnings, debts, how you spend and what you value financially. Some issues one may consider are:

- Where do they earn their income from?

- Do they have any liabilities or borrowings?

- When it comes to financial matters, how do they usually behave?

- What are some of the objectives you would want to achieve within a short duration and long term?

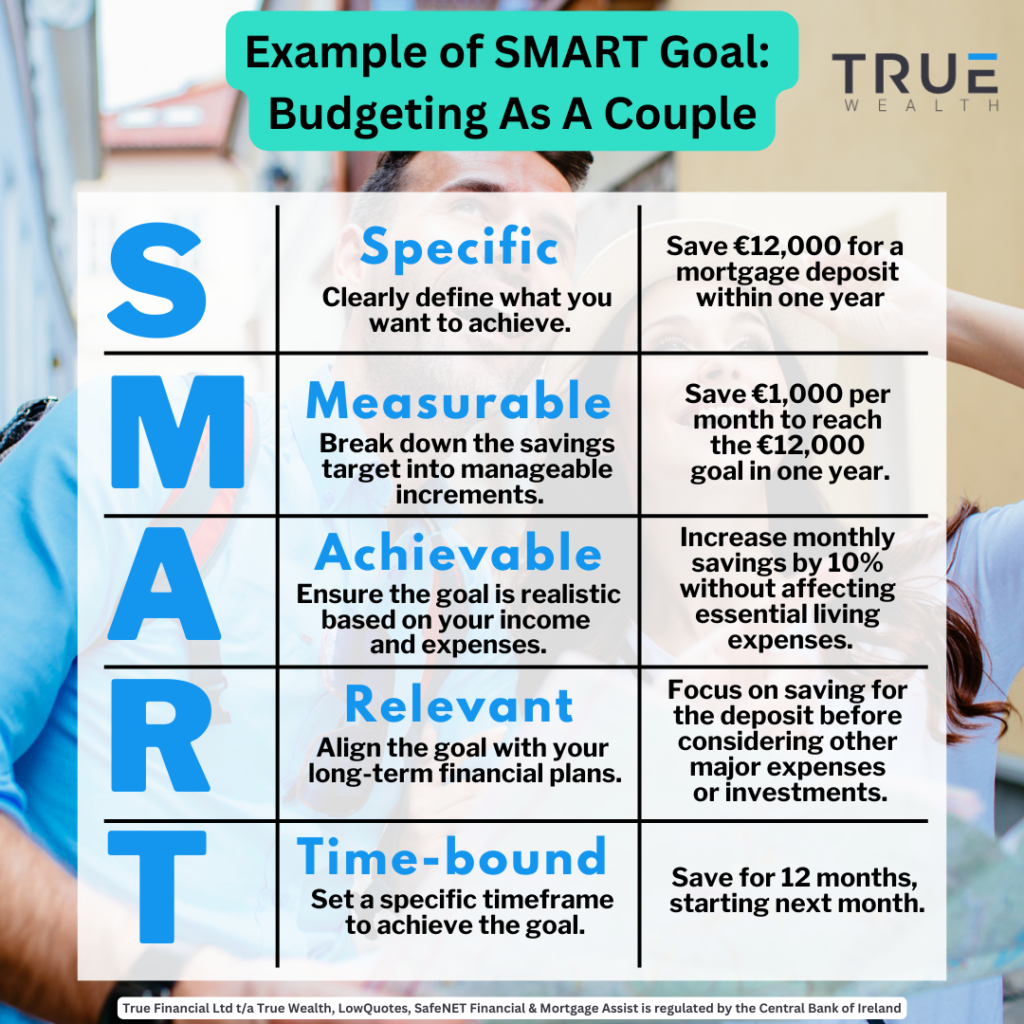

Set Common Financial Goals

Outline mutual-finance goals. Whether saving for a holiday trip among many others like getting rid of loans or establishing an emergency account, joint goals will keep individuals motivated towards realizing them.

Determine Your Financial Roles

Determine how finances will be managed as a team. Will one individual handle all finances while both stay involved? This will prevent mix up along the way as well as ensuring that everyone contributes in managing finances.

Step 2: Assess Your Combined Income and Expenses

However after the primary conversation has been held it is time for details about your finances. Start by evaluating your combined revenue and expenses.

Calculate Your Combined Income

Sum up all income sources that exist such as salaries, bonuses, freelance work and other means of earning. This will help you get a clear picture of the total amount available for spending in a month.

Track Your Joint Expenses

Next, track your joint expenses including the rent or mortgage payments, utilities, groceries, transportation and other common expenses. These costs should be categorized into two; fixed (such as rent) and variable (like dining out).

Identify Areas for Improvement

Analyze your spending habits to find out where you can cut down on expenses. Do you have subscriptions or services that are not being utilized? Are there less costly options when it comes to eating out or amusement? Identifying these areas will enable you to have more money towards your financial targets.

Step 3: Create a Joint Budget

With an understanding about what you make and spend individually, now create a joint budget. A joint budget is a financial plan that describes how one will use their combined earnings for their household expenses, savings and long term goals.

Choose a Budgeting Method

There are many ways through which couples can budget. Some of the most common ones are:

- 50/30/20 Rule: Divide 50% of your earnings among necessities, 30% for luxuries while remaining 20% goes to saving or paying debt.

- Zero-Based Budget: Every single dollar has a reason behind it. Allocate one specific expense or saving goal to each of your dollars and cents.

- Envelope System: Use separate envelopes for cash in different categories. When you run out, you are done spending on that particular item for the month.

Choose the method that suits both of you as a couple and aligns with your financial objectives.

Set Spending Limits

Set spending limits for each category based on your chosen budgeting method. Ensure these limits are realistic enough and provide some room for maneuvering. This means that the budget should be agreeable to both partners while reflecting their shared financial goals.

Include Savings in Your Budget

Do not ignore allocating part of your income to savings. It may involve contributions to an emergency fund, retirement accounts or funds meant for specific purposes like deposit money for purchasing houses.

Step 4: Manage Joint and Separate Accounts

Many couples wonder whether they should maintain joint or separate bank accounts. It depends on individual preferences and financial situation. Consider the advantages and disadvantages of these approaches:

Joint Accounts

Pros:

- Makes bill payments and sharing expenses simpler

- Ensures transparency and fosters trust

- Facilitates monitoring of collective financial targets.

Cons:

- Can cause conflicts if spending habits differ

- One could feel less autonomy over his/her own expenditure.

Separate Accounts

Pros:

- Offers more financial autonomy .

- Encourages less disagreements about spending habits .

- Allows for guilt free personal shopping.

Cons:

- Requires increased synchrony on shared expenses.

- May result in a lack of transparency.

A Hybrid Approach

Many couples find that they achieve the most success with hybrid approaches. For instance, there can be a common account to cater for their shared expenses like rent, electricity bills and foodstuff amongst others while the two may each have an individual account to spend on personal needs. This way, joint costs management is still possible alongside some level of financial independence.

Step 5: Regularly Review and Adjust Your Budget

It’s incorrect to think that budgeting is something you do once and forget about it. Always make sure that you regularly revise your budget according to changes in your financial situation or goals.

Set Monthly Budget Meetings

As such, set aside monthly budget meetings where you will look into your finances. During these meetings, discuss any change in income or expenditure, evaluate how far you have reached with your goal on finance and lastly adjust your budget accordingly where necessary.

Be Flexible

Life sometimes takes an unexpected turn and affects our budgets; therefore they should be flexible enough to accommodate unplanned expenses and changes in circumstances. Don’t hesitate tweaking it but talk to your spouse before making final decisions regarding changes.

Celebrate Your Successes

Regardless of the smallness, never forget to rejoice in your financial achievements. These could be paying off credit card debt, saving a certain amount of money or maintaining a budget for the whole month. Doing this will always keep you motivated and dedicated throughout your financial journey as a couple.

Step 6: Address Financial Disagreements Constructively

Nonetheless, arguing about money is normal in any relationship but how you handle it matters very much. Here are some simple ways to manage financial disagreements without ruining your relationship:

Stay Calm and Respectful

Be calm and respectful when dealing with any financial dispute. Avoid blaming or criticizing your partner; instead work together towards finding an amicable solution.

Listen to Each Other’s Perspectives

Listen to your partner’s perspective and try to understand their concerns. Recognize what they feel and cooperate with them so that both of you can reach a compromise.

Seek Professional Help if Needed

If there is no headway in resolving financial disputes, or if they have started adversely affecting your relationship, it may be necessary to seek advice from professionals like a finance expert or marriage counselor who will remain non-partisan throughout this period. A professional can provide objective advice and help you navigate your financial challenges as a couple.

FAQs: Budgeting for Couples

1. Should couples split expenses 50/50?

The answer isn’t straightforward since different couples have various preferences regarding splitting finances 50/50 while others split based on their individual income levels. The key is to come up with an arrangement that seems fair for both partners.

2. How can couples stay motivated to stick to a budget?

Couples can remain focused by having clear financial goals, marking milestones and holding budget meetings regularly. Additionally, it is essential to back one another up and work as a unit.

3. Is it okay for couples to have separate bank accounts?

Sure, it’s alright if couples maintain separate bank accounts, especially if that keeps their financial independence intact. Many couples mix both joint and individual accounts in managing their finances.

4. How can couples avoid financial stress?

Openness in communication, a well-designed budget and regular financial check-ins can avoid stress resulting from money issues between partners. Similarly, flexibility and understanding are necessary when dealing with personal finance challenges.

Conclusion

Budgeting together as a couple demands teamwork, communication, and shared dedication towards your monetary objectives. By using the steps given in this guide you’ll be able to come up with a budget for both of you that will reduce your financial stress thus enabling you to achieve your financial goals together. Remember: being successful at couple’s finance management requires staying connected; being adaptable; supporting each other along the way.